While public response has been muted so far, the Perodua QV-E is just the start of the national carmaker’s electrification strategy. Its first fully in-house-developed platform, developed in partnership with Austria’s Magna Steyr, is set to spawn several new models, and in an interview with Careta‘s Hezeri Samsuri, president and CEO Zainal Abidin Ahmad let slip exactly how many we can expect.

“There are certain things that we have planned not just for one model; we have planned them for future models too,” he said, talking about the QV-E’s battery leasing concept. “The platform or IP [intellectual property] for this EV is Perodua’s, and we have developed our platform for two to three forthcoming models.”

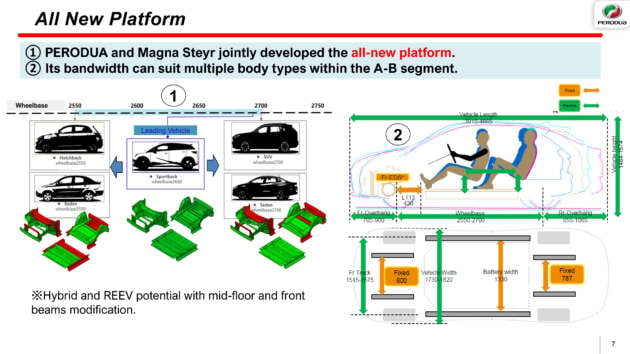

Zainal had previously already confirmed that the QV-E’s modular platform would spawn a smaller, cheaper A-segment model. The underpinnings allow for wheelbase lengths ranging from 2,550 mm (about the same as today’s Axia) to 2,700 mm (similar to a BYD Atto 3), so we could see this and a more practical SUV – one not as compromised as the low-slung QV-E – bookending Perodua’s EV range. To save costs, the cars will share much of their internal componentry, enabling a 20% commonality in tooling.

Interestingly, Zainal also confirmed that Perodua is studying the implementation of battery swapping technology for its future EVs. Such a feature would be a logical progression from the battery leasing offering the company pioneered for the QV-E and would enable users – particularly those with no access to home charging, such as those who live in condominiums – to get their cars juiced up quickly.

Zainal said there are currently a few hurdles for the company to clear first. “Right now, the issue that I am looking into is…firstly, from the aspect of homologation. Can we, for example, have a battery [from one car] in a different car at different times. This is something we are studying together with the government, with MITI and MARii.”

The other challenge is figuring out how to package the service as a compelling product. “If battery swapping [were to happen], in the future the customer…can have a full battery, go to work, and when they get back, they can go to a swapping station and change [the battery],” Zainal said. “Then the next day, they will have a full battery. They won’t have to charge. But if I want to package the whole thing as a bundle together with the whole car, how do we do that?”

This, Zainal added, is the reason why the QV-E was launched with the battery-as-a-service (BaaS) offering first, allowing Perodua to study customer data. “Will [the customer] accept it? If they don’t, is it because of the pricing? Is it because of the payments? If I have finished paying [for the car], I’d be lazy to continue paying [for the battery]. All these things are within our study.”

Perodua could take a page out of Nio, which popularised battery swapping in China. There, BaaS users get to swap their battery for a fully-charged one in just three minutes, at any of the 3,727 stations across the country – paying a swap fee and the cost to recharge their spent battery. They can even choose to change to a larger battery for longer journeys, although this will incur a higher subscription cost.

However, Perodua will have an uphill task to match the strength of Nio’s network – even if it will have to deal with a far smaller geographical area – lacking that company’s financial might and critical mass of consumers. The Chinese carmaker’s customers are also generally more well-heeled and more able to justify the various costs and fees, something the average P2 buyer likely can’t.

Zainal did go on to say that Perodua won’t be building a battery swap network alone – instead, it is looking for a partner to bear the brunt of the investment. He added that the service is being designed specifically for those living in condominiums and flats. “We could put a station [at the condo], maybe that would be an option for those people,” he said. “At the same time, those living in [landed properties] can charge as normal.”

Perodua, Zainal stressed, is looking at its EV ecosystem in a holistic manner – taking a rather direct dig at Proton and its eMas 5. “If I had put the QV-E’s price at around RM60,000 including the battery, people would say it’s a product for the masses. But we need to tell ourselves, ‘If I lived in an apartment or a flat, even if am able to buy the car, I would have problems charging it; it would become a hassle for me.’ I wouldn’t be providing a solution for those customers.”

What’s clear is that Perodua’s battery swap system will need to be a damn sight faster than what is currently possible with the QV-E. On that car, a battery change takes under 30 minutes, which is around the time it takes for it to be charged from 30 to 80% via a 60 kW DC fast charger.

Looking to sell your car? Sell it with Carro.

“If I had put the QV-E’s price at around RM60,000 including the battery, people would say it’s a product for the masses. But we need to tell ourselves, ‘If I lived in an apartment or a flat, even if am able to buy the car, I would have problems charging it; it would become a hassle for me.’ I wouldn’t be providing a solution for those customers.”

So pricing it at 80k + 30k+ for battery is your solution? Funny…

He is just being pragmatic. The costs at this point is what it is and the market will ultimately decide.

BAAS does solve many problems though

– Lower initial payment

– Battery tech obsolence (Wah in XX years batteries will be better, lighter, bigger)

– Battery SoH worry (Oh I’ll need to change battery after XX years and it will cost more than the car)

– Slow charging

The P2 EV is a blockbuster runaway success?

Is this a reality or myth?

Perhaps,Perodua can afford to write off half a billion RM in development cost,after churning out record profits the last decade.

Battery leasing or swapping,is not gonna work.Mr Perodua,u need Elon Musk to “enlighten” you?

Talk all you want..sales number doesn’t lie

Not forgetting for those in wooden stilt house at countryside settlement

Stop talking all bullshit, when u cant even manage well about ur whole QVE marketing and selling. Launch before the car ready, blaming others so call supplier as if the buyer or malaysian is dumb!

“..QV-E’s modular platform would spawn a smaller, cheaper A-segment model.

This QV-e not small enough? One need to squeeze to get it especially at the back.

Man.. sembang kari tak boleh di bawa bincang… oh well..

” his, Zainal added, is the reason why the QV-E was launched with the battery-as-a-service (BaaS) offering first, allowing Perodua to study customer data ”

To study data, first you need customers

Can Perodua tell us, how many customers do they have for the QV-E as of January 2026? How many QV-Es already on the road, driven by their owners?

Nio EV will come to Malaysia soon with huge/massive capital to start the BaaS strategy and swap stations. At least perodua have the idea in mind.

Battery swapping ROFLMAO. This guy is seriously out of touch with reality. Does he understand the magnitude of the logistics required to maintain a network of battery swapping stations? And the cost to the customer? Nobody will want to invest in that. Their charging network also habuk pun belum nampak.

Zainal added, is the reason why the QV-E was launched with the battery-as-a-service (BaaS) offering first, allowing Perodua to study customer data. “Will [the customer] accept it? If they don’t, is it because of the pricing? Is it because of the payments? If I have finished paying [for the car], I’d be lazy to continue paying [for the battery]. All these things are within our study.”

You mean these studies wasn’t done BEFORE Perodua decided to launch the whole QVE project? Either Perodua is so arrogant and thought ANY Perodua Car will sell like hot cakes or the CEO bent down to the political pressure (The idea of so called first homegrown EV). This includes Sime’s CEO who own UMW Toyota that in turn owns big part of Perodua.